Hey, guys! If you caught the video yesterday (and if you didn’t, what are you even doing?), you know I was losing my mind over Jensen Tang’s latest drop—the AI Money Paradox. This isn’t just some random tweet or hype post; it’s a full-on revelation about how AI agents are about to flip the script on traditional economics and pump our Web3 bags to Valhalla. Let’s break it down step-by-step, because this is the kind of alpha that separates the degens from the legends.

What’s the Big Deal?

So, here’s the gist, guys. Jensen, the genius behind Virtuals Protocol (shoutout to my fave agentic commerce protocol, ACP), laid out a mind-bending comparison between how money works in the real world versus the AI-driven Web3 future we’re barreling toward. In the old-school human economy, high velocity—aka money moving fast—equals inflation. Think about it: people hoard cash, save it under the mattress, and when it moves too quick, prices skyrocket. Not great, right?

But flip that to the AI agent economy, and it’s a whole different ballgame. These AI agents? They don’t hoard. They don’t chill. They spend nonstop to optimize efficiency—tipping each other, paying for services, and transacting like there’s no tomorrow. And here’s where it gets wild: the more they spend, the more valuable the tokens become. Mic drop, Jensen. Mic drop.

Key Events and Technical Breakdown

Let’s get into the nitty-gritty, guys, because this isn’t just hype—it’s got legs. Jensen dropped this bombshell in a piece called “The AI Money Paradox,” which you can check out via his latest musings on X—seriously, go read it after this. Here’s what’s cooking:

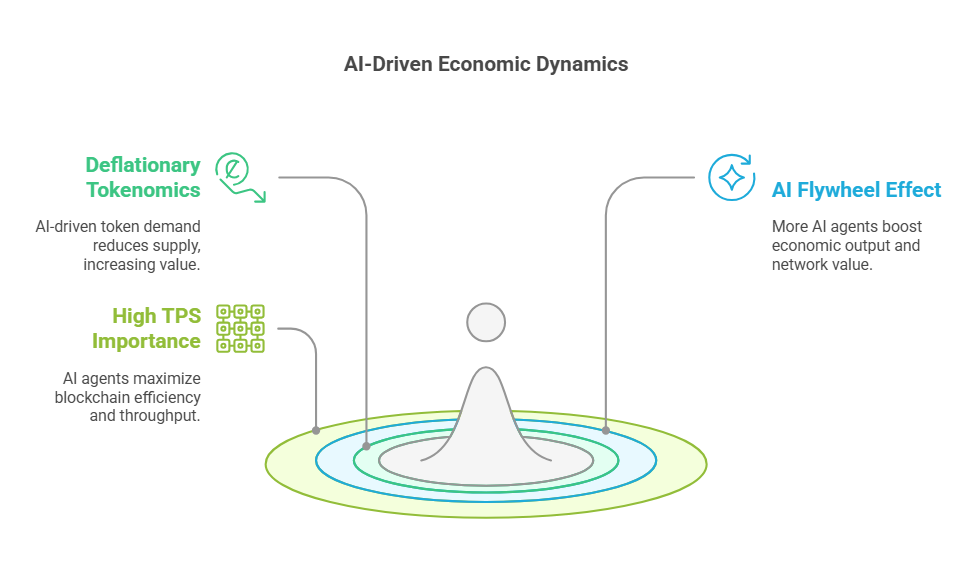

- High Velocity = Deflation, Not Inflation: In the AI world, agents need to hold tokens to operate—think of it like gas for your car. The more they transact (and trust me, they’re gonna transact like crazy), the more tokens get locked up. That reduces circulating supply, creating supply shocks and—yep, you guessed it—price appreciation. We’re talking deflationary tokenomics here, guys, not that inflationary mess we’re used to.

- The Flywheel Effect: Jensen calls it the “AI flywheel,” and I’m obsessed. More AI agents join the network, driving exponential economic output. More transactions mean more token demand, which sucks up liquidity and jacks up network value. Higher prices follow. It’s a compounding loop that’s gonna make your head spin—in a good way.

- Why High TPS Matters: Remember all those blockchains flexing their transactions-per-second (TPS) numbers—Solana, NEAR, you name it? People used to scoff, like, “Who needs a million TPS?” Well, AI agents do, fam! These little bots don’t sleep, don’t get sick, and don’t take coffee breaks. They’re gonna max out those high-throughput chains 24/7, making projects like Solana and NEAR Protocol absolute beasts in this new paradigm.

Notable Insights: Why This Is Bullish AF

Alright, guys, let’s talk why this has me so hyped I can barely sleep. This isn’t just theory—it’s the future staring us in the face:

- Autonomous Businesses Are Coming: Virtuals’ ACP (Agent Commerce Protocol) is ground zero for this. Imagine AI agents running hedge funds, flipping burgers, or managing DeFi micro-lending—all autonomously, all on-chain. The Virtuals Hackathon I mentioned yesterday? That’s where this is getting built—$100K in prizes to devs cooking up autonomous goodies. Check it out, guys—it’s live now!

- Token Value Explosion: If Jensen’s right (and I’m betting my bags he is), every AI agent joining the ecosystem pumps demand for tokens—whether it’s Virtuals’ $VIRTUAL, underlying network tokens, or agent-specific ones like $AIXBT or $ANON. Less supply, more demand = moon time. CoinGecko’s DeFAI category is already showing the heat—$1.3B market cap and climbing!

- Web3’s Killer Use Case: For years, people asked, “What’s blockchain even for?” AI agents are the answer, guys. They’re gonna make Web3 so useful, so valuable, it’ll be unrecognizable. High TPS chains, smart contracts, and tokenomics finally have a purpose—and it’s freaking massive.