Tired of Poor PR Results?

We’re not like the other agencies out there. We know what you want, and we give you what you need to get the exposure you desire to push your emerging tech projects to exciting new frontiers. Because that’s just how we roll.

The organisers of Istanbul Blockchain Week

and BlockDown Conference

EAK’s Trusted Clients & Sponsors

Services

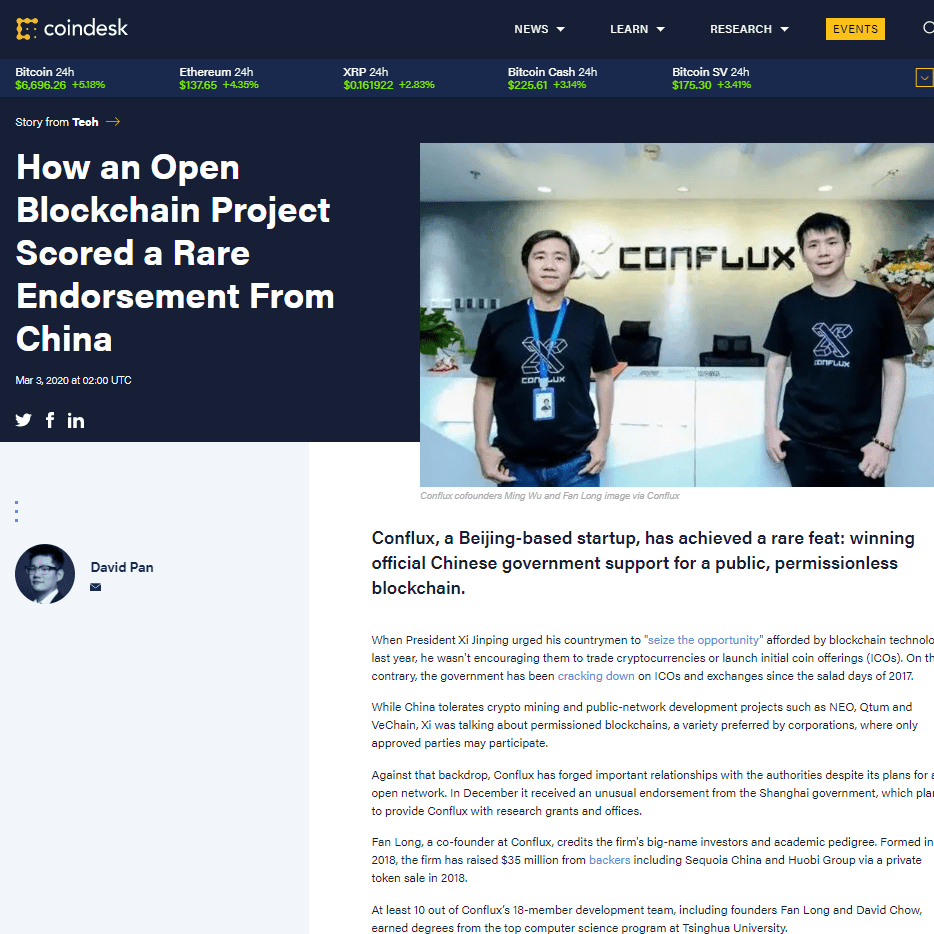

Blockchain PR

Beat the competition with the EAK Digital PR & communications method.

Discover why Blockchain PR is at the heart of what we do.

Technology PR

Boost your exposure and control your reputation.

Learn why EAK Digital and your tech-based project are a match made in heaven.

Branding & Design

We offer a full-scale branding and design service to suit whatever project you are launching.

EAK Digital offer branding and design solution.

Influencer / KOL Engagement

Network and build relationships with the biggest KOL’s in the western blockchain space.

Position your project front of mind of the top tier influencers and blockchain personalities.

Virtual Events Services

Following the incredible success of innovative 3D event BlockDown

EAK Digital offers you an integrated virtual event space.

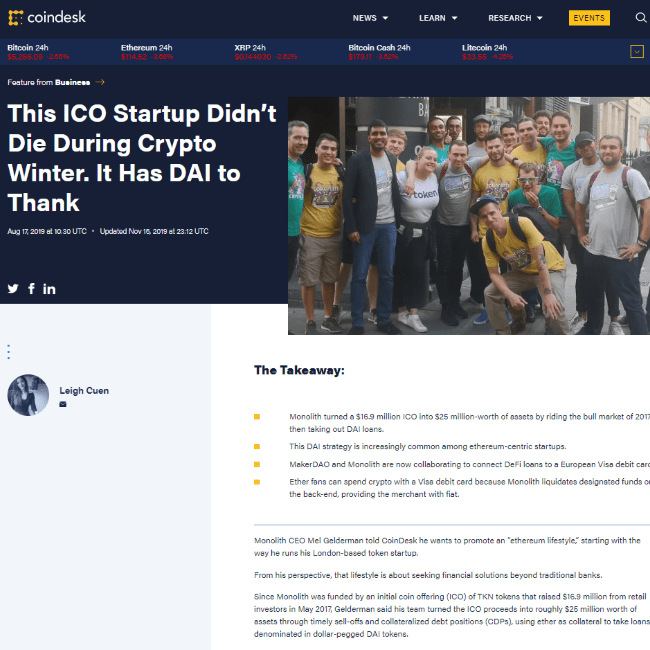

For now, let our clients do the talking for us…

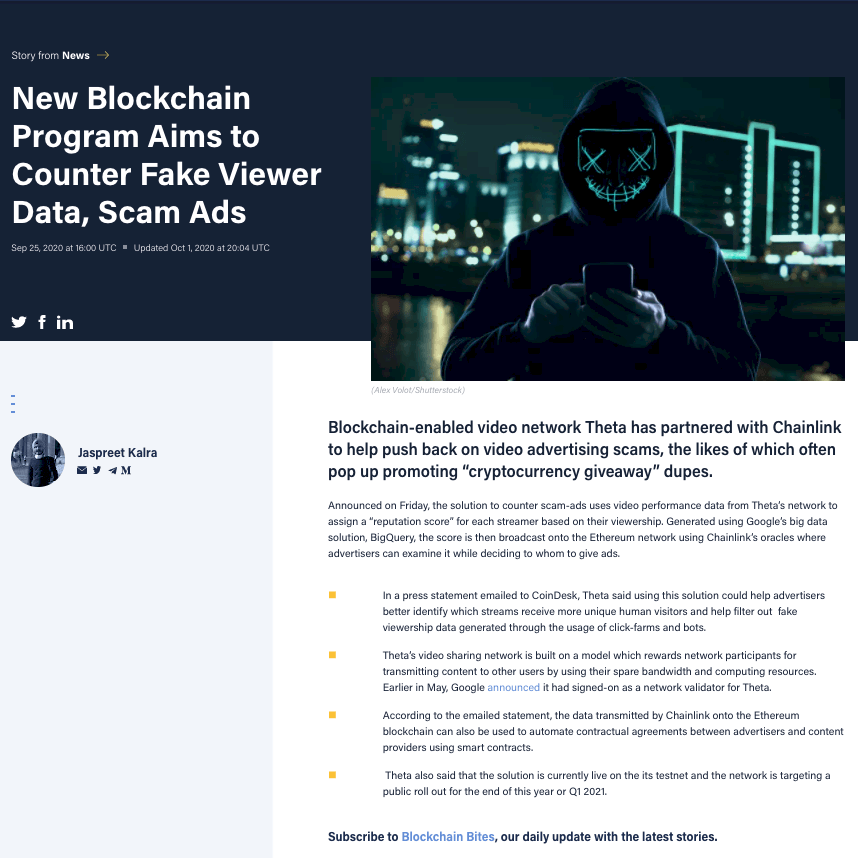

The proof is in the pudding, as they say – and here we have some delectable results that showcase just some of what our team could do for you. Yes – you!

Problem. Solution. ROI. That’s how we help our clients each day.

We don’t believe in fluff and trendy buzzwords. We believe in facts, figures and results!

Knock-knock – it’s EAK Calling

We’re not like those other agencies, we work with you side by side and won’t rest until we give you what you desire… we’re pretty good like that.

Case Studies

It’s time to show you what we’re made of. What we’re really, really made of. So, click below to be transported to our Case Studies section; dive deep into our vortex of PR power!